inCompliance assists you with your projects and developments by handling Risk Management and Compliance aspects.

Our solutions

Help with preparing

authorisation files

(FINMA, SROs, etc.)

Partial outsourcing

Risk and/or Compliance

(specific activities, substitution)

Total outsourcing

Risk and Compliance

Advice and support

Our areas of expertise

|

We work with financial intermediaries such as

|

Compliance

- AML Client onboarding and transaction monitoring

- FinSA, FMIA rules of conduct

- Cross-border

Risk management

- Setting up a comprehensive risk management system

- Risk control and reporting

Corporate Governance

- Support and assistance with the company’s development

- Introduction of new products, internal guidelines, assistance to the Board of Directors and Management, etc.

FACTA / CRS / QI

- Help with managing documents and classifying clients

- Help with preparing mandatory reports

Authorisation requests and documentation

-

Legal assistance and support for activities subject to authorisation

- Help with implementing or modifying client contractual documents

- Contact with our network of financial law experts if necessary

In-house training and solutions with our partner VisionCompliance

- Customised in-house training in Risk Management and Compliance

- Help in defining training needs

link to VisionCompliance

External training

Support for your projects and your personal development

Internal training as part of our outsourced activities

Help in defining real needs and a training plan geared to the business model

Our training partner

inCompliance aims to provide the best training to its clients, who include private and collective asset managers, trustees and advisors. Our partner, VisionCompliance, offers high-quality training covering all our clients’ needs, particularly :

Our origins

inCompliance was founded in Geneva by three experts in the fields of law, risk management and financial and banking compliance.

It is a spin-off of the company VisionCompliance, a training-centred company that has been around for some twenty years. For almost a decade, inCompliance has been focusing on outsourcing Compliance and Risk Management services for local financial intermediaries.

It relies on a large network of recognised financial law and auditing specialists.

In addition to pure business outsourcing, our team has always been ready to guide and assist our clients with their development projects.

It is a spin-off of the company VisionCompliance, a training-centred company that has been around for some twenty years. For almost a decade, inCompliance has been focusing on outsourcing Compliance and Risk Management services for local financial intermediaries.

It relies on a large network of recognised financial law and auditing specialists.

In addition to pure business outsourcing, our team has always been ready to guide and assist our clients with their development projects.

Contact us

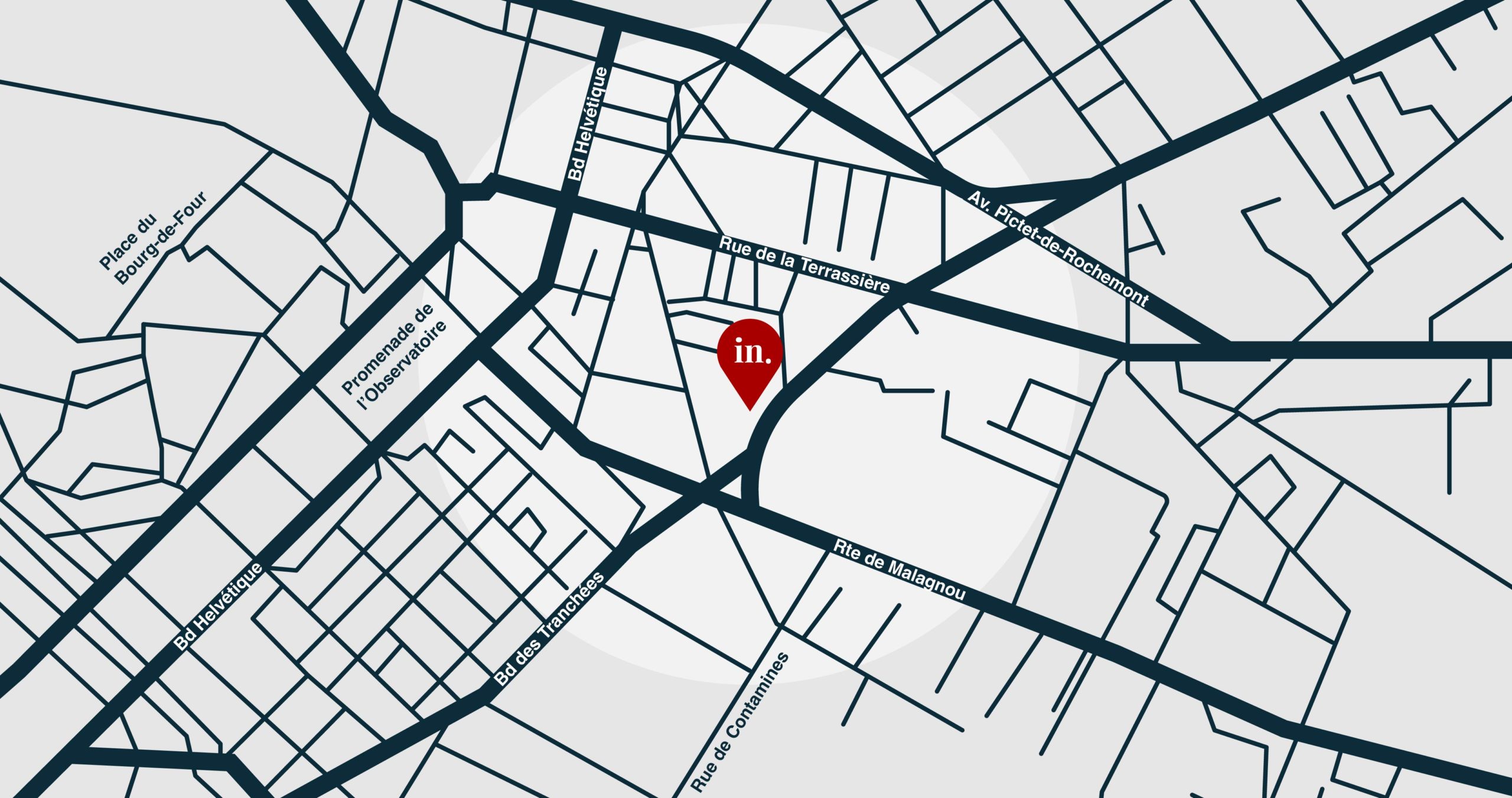

Located in downtown Geneva, inCompliance is close to both the banking district and Cornavin train station.

or via the form opposite In Compliance

Rue de Villereuse 22

1207 Genève

Our team is available to answer your questions : +41 79 644 58 19

contact@in-compliance.ch

or via the form opposite

Our team

Our committee of experts

To support our team and identify all applicable regulatory or legal changes, inCompliance has set up a Committee of Experts within its network, composed exclusively of banking and financial law specialists.

This Committee is designed to combine expertise acquired in the field with that of recognised specialists in their areas of competence. It meets regularly to review issues that its members have come across in their respective activities. The aim is twofold: to identify the best possible ideas and outcomes for our clients, and to strengthen skills within inCompliance.

This Committee is designed to combine expertise acquired in the field with that of recognised specialists in their areas of competence. It meets regularly to review issues that its members have come across in their respective activities. The aim is twofold: to identify the best possible ideas and outcomes for our clients, and to strengthen skills within inCompliance.